SEO

There’s arguably been no greater development in recent years than AI. The technology is evolving at a rapid pace, and search engines are channelling more resources than ever into advancing their AI capabilities.

But with Google’s slow integration of the Search Generative Experience (SGE), are we seeing a cooling off period? Or is Bing stealing market share while Google sleeps? With 2023 out of the way, we dive into the data and provide a round up of the state of AI in search.

Recent trends in demand for AI tools

When OpenAI launched version 3.5 of their AI chatbot ChatGPT at the end of November 2022, there was a huge amount of both press and public interest.

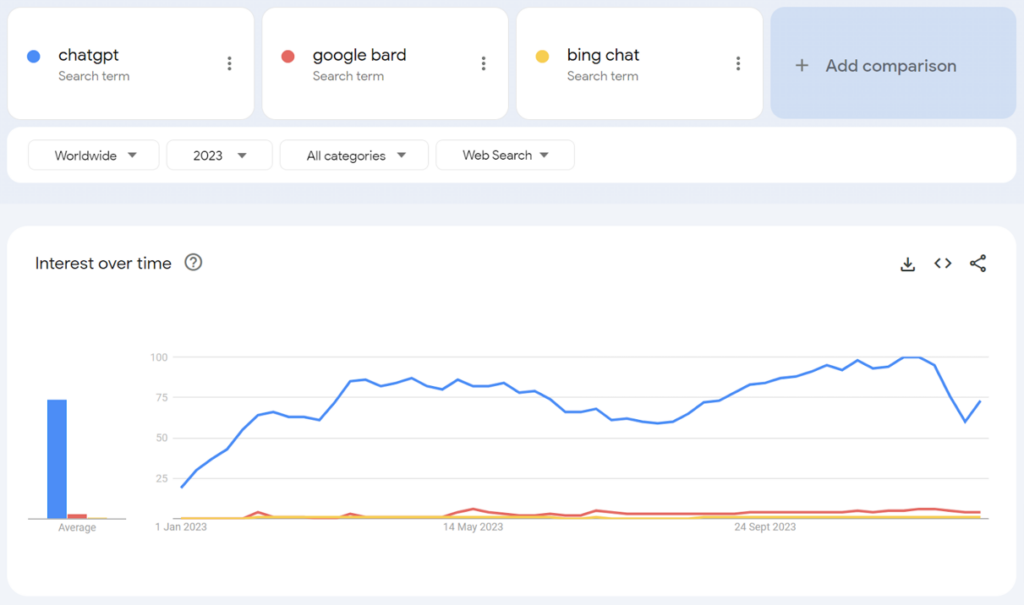

The volume of web searches for the term [chatgpt] increased steadily until an initial peak in May 2023 (following on from the release of version 4 in March). From there, volume decreased until mid-August, whereupon it started to move upwards again towards 2023’s peak level in late November, before declining over the winter holidays.

Searches for [google bard] (and [bing chat])* have been significantly lower, despite Google’s reactive efforts to match the levels of awareness ChatGPT generated.

*Renamed as ‘Copilot’ in November 2023.

Worldwide searches for [chatgpt], [google bard], and [bing chat] across 2023. Source: Google Trends.

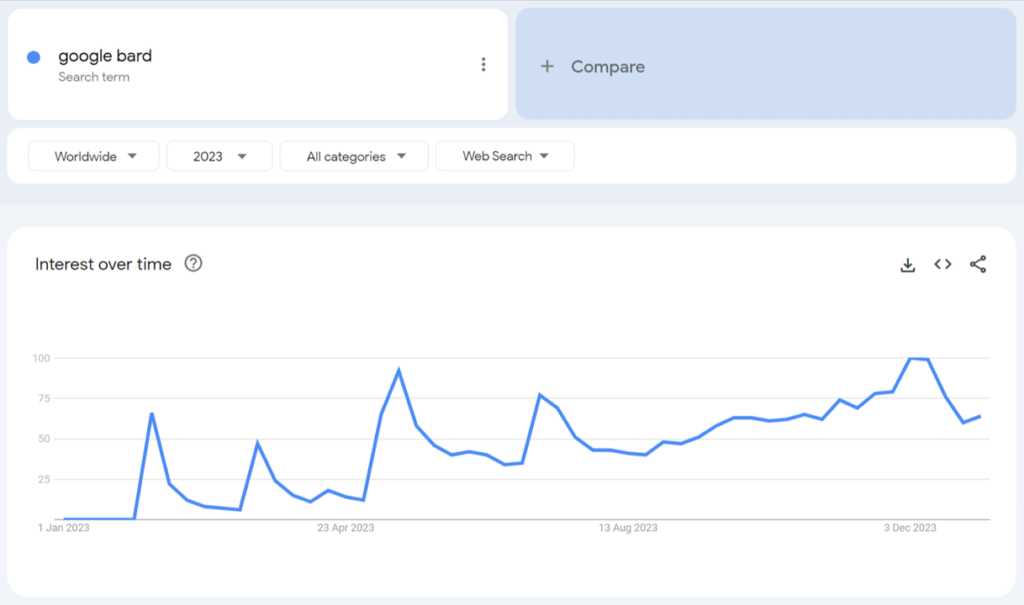

Worldwide searches for [google bard] across 2023. Source: Google Trends.

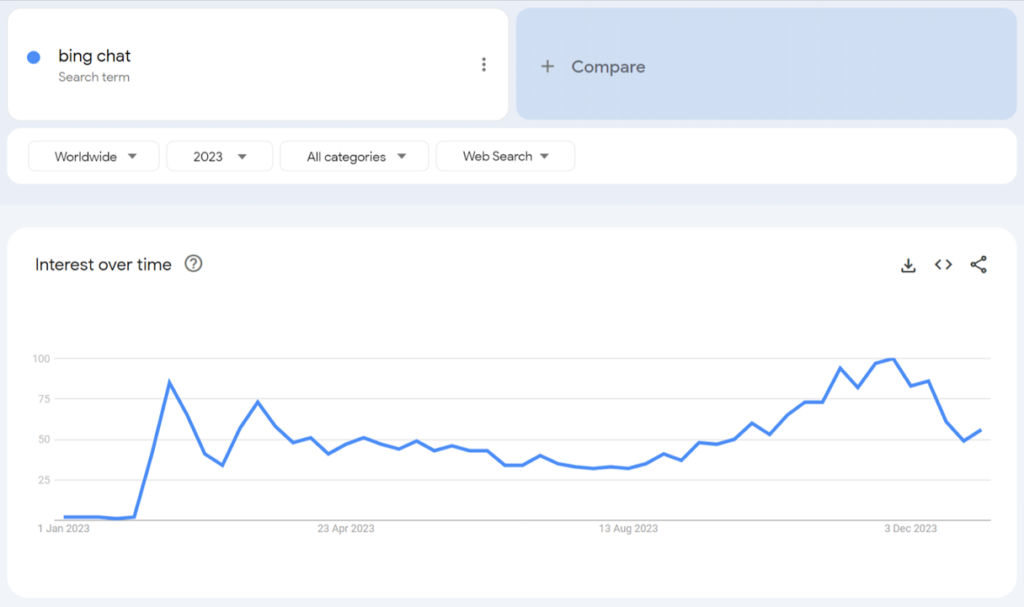

Worldwide searches for [bing chat] across 2023. Source: Google Trends.

Search engine market share?

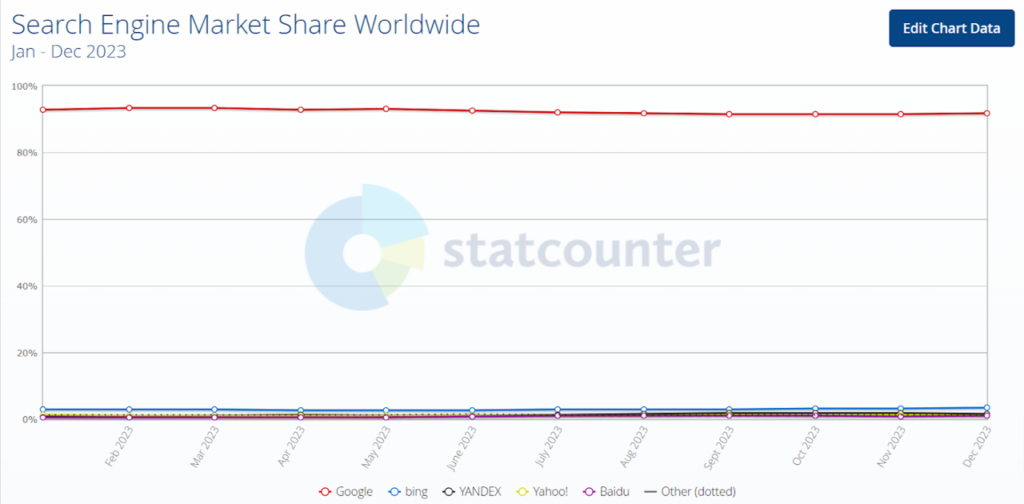

StatCounter data from December 2023 shows the following split of search engine market share worldwide:

Search engine market share worldwide – December 2023. Source: StatCounter.

Looking across 2023, we can see that following on from the launch of ChatGPT 3.5 (where Bing were at 3.59%), from January their share decreased to a low of 2.76% in April, whereupon it steadily increased to an annual peak of 3.38% in December.

Despite the media hype – and Microsoft’s substantial investment in AI integration – it’s clear that while Google shouldn’t be complacent, they don’t have to worry too much about losing their grip on world search domination.

That said, Google did experience a minor initial decrease after the launch of ChatGPT 3.5 from 92.42% in September 2022 to 92.21% in November 2022.

Across 2023, from an initial 92.9% share in January, and a subsequent annual peak of 93.37% in February, levels decreased to 91.62% at the end of 2023.

Search engine market share worldwide across 2023. Source: StatCounter.

Search Generative Experience

In May 2023, Google announced their new Search Generative Experience (SGE) was available for testing. This uses generative AI to give users more information and context to their searches. Available initially to US users only, in August it was also made available to India and Japan, and then expanded to 120+ countries – while we still eagerly await its launch in the UK.

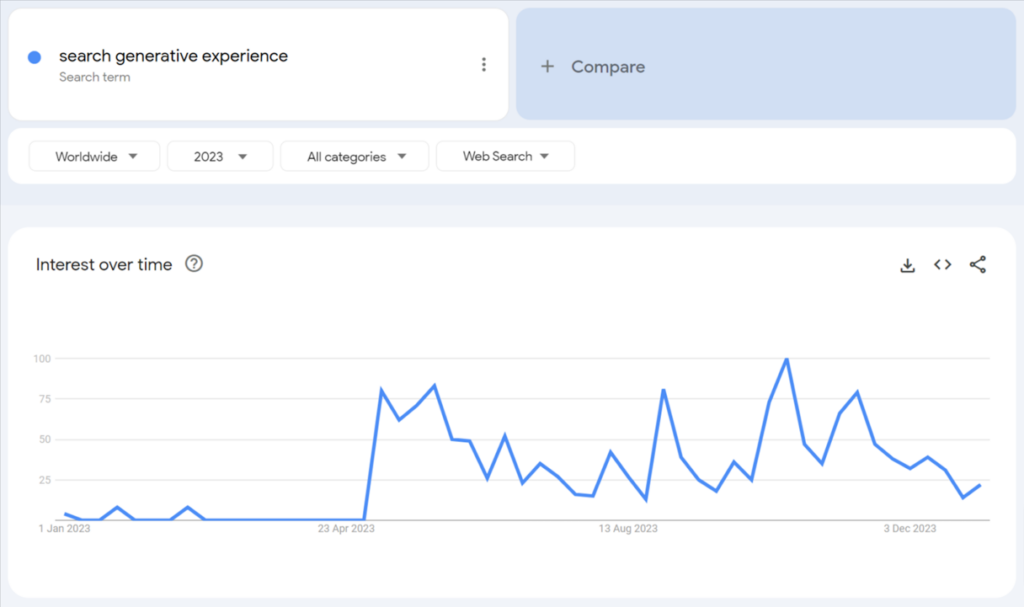

Spikes in searches for [search generative experience] can be seen following its announcement and then its release in India and Japan, as well as a peak in October – perhaps related to the upgrade it had at that time which allows it to create both images and text, followed by a lesser surge in demand in November, after its expansion to 120 countries and four new languages.

Worldwide searches for [search generative experience] across 2023. Source: Google Trends.

Demand for AI tools in general

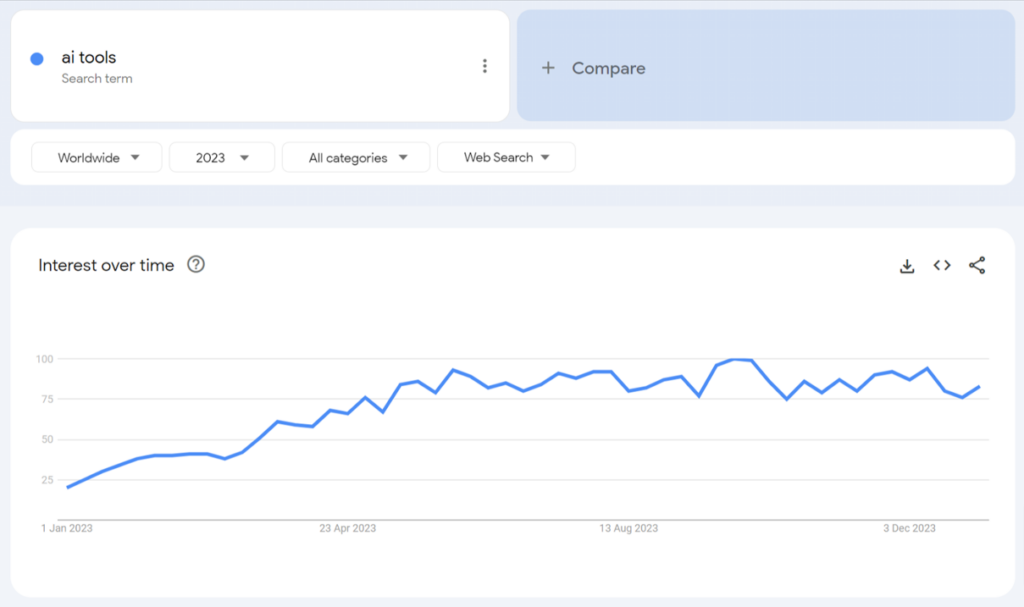

Outside of interest in specific tools and search engines themselves, if we look at demand for [ai tools] across 2023, interest grew continually throughout the first half of the year, but since then has plateaued and essentially remains at a stable level.

Worldwide searches for [ai tools] across 2023. Source: Google Trends.

So what could this all mean?

ChatGPT has dominated the public discourse

The novel and impressive nature of ChatGPT 3.5 upon its release – and the associated media coverage – caused an understandable surge in interest that continued to increase for a number of months until shortly after the release of version 4. Although there was a subsequent lull across the summer months, demand then grew to even higher levels throughout the remainder of the year – only dipping around the winter holidays.

It’s fair to assume that Google Bard and Bing Chat/Copilot are also lesser-known entities in general public discourse and as such have been searched far less frequently to date.

Users started to experiment with SGE

In May 2023, the testing launch of SGE may have contributed to a decline in users utilising ChatGPT and instead exploring SGE. The decline in searches for [chatgpt] is more pronounced in the US where SGE was solely available at that time, rather than worldwide.

The initial peak of searches for [google bard] in May is also very likely due to the testing launch of SGE, and the subsequent annual peak in December is almost certainly related to Google’s announcement of their most advanced AI model yet, Gemini (along with the associated hype that their promotional video generated – that was, at best, economical with the truth).

Fluctuations in public interest

Part of the decrease in interest for many search terms from May to August might also be due in part to general AI fatigue and hype decline. The tools are being used and experimented with less by those outside of tech and associated industries for example, and there was also a seasonal drop in summer usage around holiday periods.

This could indicate that currently users utilise AI tools much more for work purposes than for day-to-day activities.

Lack of trust

AI hallucinations and lack of accuracy have eroded some of the initial excitement around the capabilities of generative AI. The recent developments at OpenAI involving Sam Altman – and his former board expelling him for ‘lack of candour’ – has also diminished trust in this new technology at a time when it needs to be unimpeachable. Similarly, Google’s misrepresenting of Gemini’s new capabilities eroded trust in the company’s AI innovations.

Bing’s position in the market…

The initial peak of searches for [bing chat] in February naturally correlates with its official launch – perhaps as well as Google’s unflattering media coverage and subsequent drop in market value around the same time.

But the following reduction in demand across the middle of 2023 is perhaps also a reflection of its efficacy at this time compared to the other AI tools, coupled with Bing’s overall smaller user base. That said, since August, demand started to grow and return to the initial peak levels, even exceeding this after November when it was rebranded to Copilot.

… versus Google’s position in the market

Google still intensely dominates the world of search. While they are very likely to remain in position #1 for a long time to come, Bing has nonetheless experienced growth. Their decrease around the testing launch of SGE was not as long-standing as many sources predicted and they have since regained market share to a level fairly close to their post-ChatGPT launch peak. Against this, since the testing launch of SGE, Google’s market share has actually decreased (from 93.11% in May to 91.62% in December).

The uncertain future of SGE

While Google may have seen a decrease in market share since the testing launch of SGE, outside of the summer lull, it is probably too early to say how SGE (and the interest in it) will evolve – and demand has fluctuated significantly throughout the year.

This is partly due to the launch in India and Japan – and the subsequent rollout to 120 additional countries – that colours the data set, and also because it will be integrated into their core search product and as such perhaps not be seen as a distinct entity, unlike ChatGPT, for example.

The inevitability of AI

Despite all of the media hype, tech leader jostling – including firing and rehiring – and Google finding itself on the back foot for once, regardless of which corporation’s tool is in first place, interest in AI tools has been steadily increasing up to a point where it might now be naturally stabilising.

While it could be that now the initial dust has settled and most users are utilising these tools more for work purposes – and experimenting less – it’s likely and perhaps inevitable that they will be seamlessly integrated into multiple aspects of our lives, perhaps even to the point where we don’t really notice them anymore.

What’s next for AI and search?

No doubt when electricity first entered widespread usage, it was its very existence as much as the items it powered that dazzled users. Perhaps something similar will happen with AI over time – it will become so essential to our everyday lives that it is almost invisible.

For now, however, it’s exciting to be immersed in the pioneering early days. Search engines and users alike are still learning about and adapting to this groundbreaking technology. We look forward to how it will enhance, disrupt, and merge with both search and our daily lives.

Want to find out more?

We’re already using AI to evolve our approach to SEO so that we can help our clients in a more efficient and innovative way.

If you think your business could benefit from our use of AI in SEO, get in touch with our experts.