Media

Apple has spent the last few years making waves in the advertising industry through its software updates, most notably:

2016: The launch of Apple Search Ads

2017: Intelligent Tracking Prevention (ITP) in Safari limiting cross-website tracking

2021: OS14.5 adding AppTrackingTransparency, limiting how users can be tracked in apps such as Facebook

2022: iOS 15 adding Mail Privacy Protection, which will hide email open rates from advertisers

And it seems they’ve got no intention of stopping yet.

Recently there have been rumours of Apple building their own DSP (demand-side platform), with a job ad spotted looking for someone to “drive the design” of a “privacy-forward, sophisticated demand-side platform” (archive link provided, as listing has now been removed).

This is not the first time Apple has explored this space – there are plenty of articles detailing the history and eventual sunsetting of iAd back in 2016. The market however has changed considerably since then, as has consumers’ understanding of the digital marketing ecosystem.

Before talking about what this could look like, is this a natural move for Apple?

Apple’s privacy crusade

In recent years Apple has leant into being the platform that values user privacy above all else. This stands in contrast to their main competitor Android, which as a division of Alphabet, is ultimately funded by advertising – much of which uses “audience data” in various forms for ad targeting.

This is exemplified by Apple’s “Privacy, That’s iPhone” campaign. First launched in 2019, these ads set out to inform consumers of how their data is used by the ad industry. The campaign positions Apple as standing between consumers and unscrupulous data buyers and sellers, harvesting their data without consent for use in targeted advertising.

The ads themselves are (of course) very well-made and struck a chord with consumers – who would want to have their every purchase monitored, or their browsing history sold on to whomever wants to buy it? It also plays well to their hardware offering, as Apple no doubt wants users to be confident in their data security, given the amount of intrusive personal data that could be gathered by combining an Apple Watch (biometrics) with an iPhone (web browsing history).

“Privacy, That’s iPhone” came at an interesting time, with user data and privacy starting to gain a foothold in the public consciousness. Whilst there has always been an undercurrent of awareness of the business models of Big Tech and their reliance on data-fuelled advertising, this has certainly been on the rise in the past few years.

Using the UK as an example, the introduction of GDPR in 2018 (bringing data and privacy into the working lives of many), as well as coverage of Cambridge Analytica in 2019 and the Brexit vote, all meant the average person was starting to become more aware of how their data was being monetised by the “free” platforms they used. As the adage goes:

“If you are not paying for it, you’re not the customer; you’re the product being sold.”

How could Apple’s own DSP work?

We can already get a read on Apple’s take on an ad platform with their app promotion offering, Apple Search Ads.

The platform heavily limits the tools advertisers have by design, handing control over to users. There is no third-party data buying, no audience data, and no reporting visibility beyond installs.

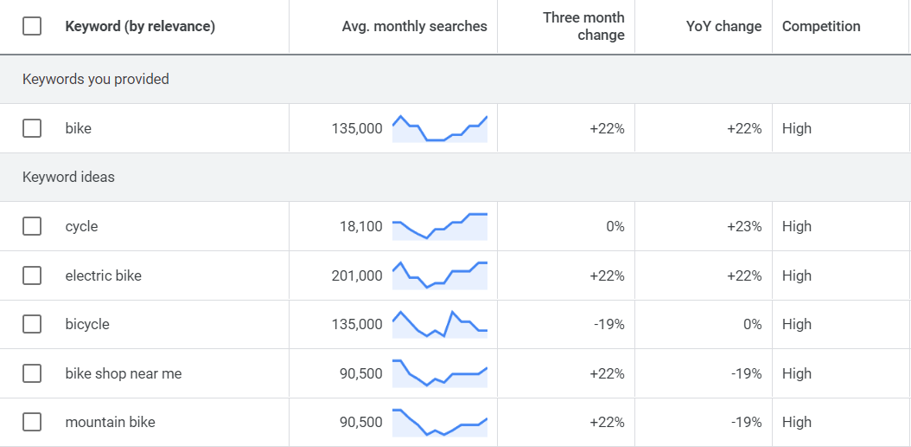

As an illustrative example, Google Ads provides advertisers with a detailed view of keyword volume, trends, competition, expected CPCs and more:

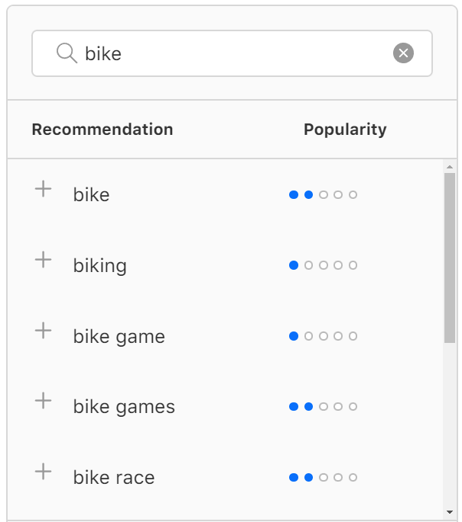

Whereas on Apple Search Ads, we can only see query popularity on a 1-5 scale, allowing advertisers to understand what queries get search volume, but no more detail than that.

Whilst this will partly be a result of the sheer amount of data Google has available, it is instructive when looking at the ethos behind both platforms.

What’s next?

Whilst we’ll need to keep a close eye on how this plays out, there are a few key takeaways to keep in mind:

- Apple’s walled garden approach to its ecosystem, tightly aligning its hardware and software to give users the best experience, is what got them to where they are today. However, iAd demonstrated that this was a detriment when it comes to the business of buying and selling ads.

- The world has changed a lot since 2016 however, and there may be a way to make this work in the current climate.

- Any move back into the wider digital marketing ad space will naturally come with a lot of eyes on it, and a lot of pressure to succeed this time.

- With Apple championing user privacy, any DSP they operate is unlikely to provide the level of targeting advertisers are used to, as we can see already with Apple Search Ads.

- It feels like they may lean on the value of the iOS and macOS user base – instead of the detailed criteria that many data brokers offer for sale.

- This may be a tricky (but not impossible) line to tread with their own marketing efforts.

- A “privacy focused DSP” is an entirely new proposition – can Apple offer advertisers something more than they can get elsewhere?

- In the background is something Alphabet has struggled with, antitrust and fair competition legislation.

- Apple already has yearly revenues greater than many countries, and a move to consolidate ad buying on a platform they own might cause concern.

With the right partner, demand-side platforms will make your digital ad experience easier and more cost-effective. At RocketMill, we review and work with a range of programmatic partners to give our clients the leading edge. We will closely monitor further developments on when (or if) Apple returns to the programmatic ad tech space, to ensure our clients are best equipped to take advantage of the strategic opportunities it could offer.